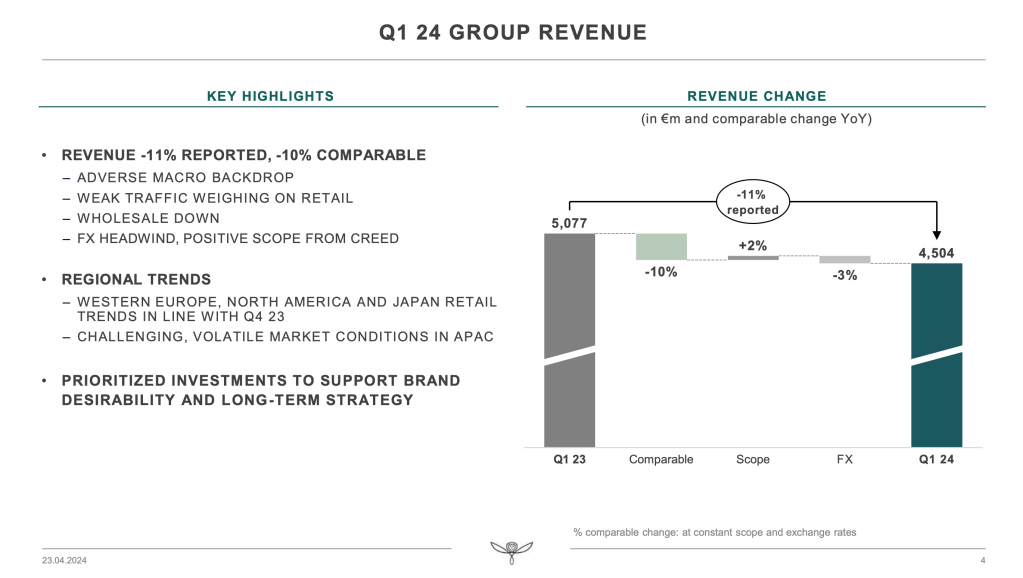

In late April, Kering released its quarterly earnings for the first three months of 2024, and it is not as pretty as its houses’ designs… The economic slowdown currently unfolding has touched most of the fashion and luxury industry, with some notable winners in Hermès or even the Prada group. But at Kering, the struggles are amplified by a creative crisis reverberating particularly strongly on the fashion houses part of the group (vs luxury houses like Hermès or Chanel).

Any luxury fashion observer would agree that Kering woes are not new. Yet, most were surprised when it announced an expected drop in profits of 40-45% for the first half of 2024, a staggering number for an industry that has encountered an exponential growth since the pandemic.

Kering’s problems are most likely structural. Yet, the core of the industry’s success, creative strategy, tends to be defined in-house. The holding, in nature, should only give directions and empower its distinctive houses to build their own independent narrative to stand out against competition. Notably, it is the strategy of the LVMH holding. But, for Kering houses, the creative strategy – or apparent lack thereof – has been an issue at every house, not just at leader Gucci. This duality unveils one of Kering’s problems: defining a direction and sticking to it, over time.

Indeed, since Alessandro Michele stepped down as creative director of the Florentine house at the end of 2022, the more quiet, sartorial approach of Sabato de Sarno has struggled to overturn declining sales. While the CFO underlined that not all of de Sarno’s products have hit stores yet, the marketing campaigns and products have not produced the kind of excitement Michele was able to entice. Will Sabato be able to make Gucci a cultural conversation again ?

The second brand of the group, Saint Laurent, is also struggling to stand out in front of competition. The toned down, simple lines of Anthony Vacarello are often compared to those of rival Hedi Slimane at Céline, former creative director of Saint Laurent. From the clothes to the stores, the creative identity of Saint Laurent has drifted far (too far?) away from the late Yves Saint Laurent’s creative world.

When it comes to Balenciaga, the PR scandal during which the house was accused of sexualizing children at the end of 2022 is only starting to rescind. Additionally, Kering decided to stand by both its CEO and designer, a surprising move given the fact that Pinault is usually not shy when it comes to shaking things up, even if it includes cutting once extremely successful heads.

Truth is, when it comes to Gucci and Balenciaga, the headwinds can be attributed, at least partly, to bad timing. But the widespread and long-lasting problems point towards cross-house structural issues at the Kering level. The first one, widely pointed by analysts and observers, is distribution, coupled with merchandising and last but not least, the tension between fashion and luxury that is particularly felt in times of economic uncertainty.

Compared to many competitors, Kering does not engineer scarcity for any of its brands or products. This means it has probably missed several opportunities to create iconic bags and other accessories able to rival LV’s Speedy, Hermès’ Kelly or Chanel’s 2.55. Additionally, its reliance on outlets and reduced items alters the equity of its brands and eventually hurts his houses’ topline.

Merchandising is also particularly underwhelming, except maybe at Bottega Veneta, the only house showing a growth in profit in Q1. In a time where experiential marketing is front and center and more luxury houses are expanding into hospitality, the stores fail to create excitement, by hosting pop ups or events for example.

Finally, Kering has not been able to establish its Maisons as luxury names able to compete with the likes of Hermès, or even LVMH. Indeed, Gucci, Saint Laurent and Balenciaga have been about short-term success since being acquired by the group and have drifted away from their core identity for many clients. Cristobal Balenciaga’s mastery of shape is hard to see in the extremely edgy designs of Demna.

In fact, Kering’s houses are struggling to be cultural. They fail to reference their own history, an essential endeavor when it comes to building lasting brand identities able to withstand economic cycles. In order to create attachment, brands need to connect with consumers that buy their products not for the fashion or the design, but for the stories, craftsmanship and ideological associations it stands for. That is what the luxury industry is about, and that is part of why Kering has not been able to rival LVMH since fighting it for the acquisition of Gucci in 2004.

Truth is, as opposed to quarterly results that are short-term if not immediate indicators, creative and cultural factors need time to mature. Trends’ cyclicality tends to be longer than the financial calendar, while luxury’s cycles are even longer if happening at all. After all, Hermès really is in a league of its own and has been for some time. Kering needs to be patient, but can patience be part of its business model? Time will tell…

Leave a comment